How to Refinance Your Car

Apr 20, 2023 By John Davis

Do high-interest rates on your auto loan burden you? Have you noticed your car payments rising lately? Refinancing your car could be the solution to save money and reduce monthly payments.

In this blog post, we'll provide an overview of everything you need to know about refinancing a car loan, from crunching the numbers to finding the best lender. Whether it’s been a few months or several years since buying your vehicle, read below to explore the possibilities available when refinancing.

Understand Your Credit Score and Financing Options

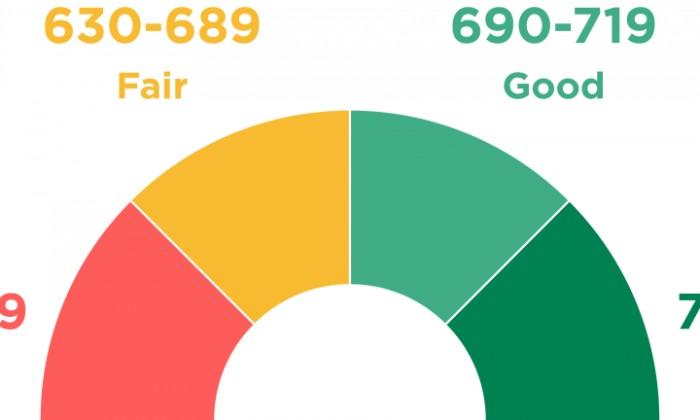

Understanding your credit score and financing options is important before refinancing your car loan. Credit score is a three-digit number which used by lenders to determine how likely you are to repay debt.

The higher your score, the more attractive terms of loans you can receive. If you want to refinance your car loan, you must check your credit report for any errors or fraud that may affect the rate and terms available from lenders.

You should also consider the different financing options available when refinancing. Depending on where you live, there could be banks, credit unions, online lenders or auto dealerships that offer car refinancing services. Before selecting the right lender, shop with at least two or three lenders to compare rates and terms.

Don’t be afraid to bargain or negotiate to secure the lowest rate possible. Read all disclosures thoroughly to understand any fees or penalties associated with refinancing.

Ensure you crunch the numbers correctly when assessing your potential savings from refinancing a car loan.

While it may seem attractive on paper, taking out another loan may not be worth if the refinancing costs outweigh the potential savings.Research carefully and explore all available options before making any decisions. With these tips, you can decide how best to refinance your car loan and save money in the long run.

Calculate Your Interest Rate and Repayment Options

When considering refinancing your car, it’s important to understand the interest rate you are currently paying on loan. How much you pay in interest directly impacts your monthly repayments and the overall cost of borrowing over time. To calculate the interest rate, divide the amount you borrowed by how much you pay each month.

Once you have your current interest rate, consider what other repayment options may be available to you. Shop around for better rates and terms and conditions that meet your needs. Doing so will help ensure you receive a fair deal when refinancing your car loan.

Research Refinancing Companies and Compare Quotes

Comparing quotes to find the best deal is important when researching refinancing companies. Several factors can affect a company’s quote, such as credit score, loan amount and term length.

If you have good credit and an existing car loan with an interest rate higher than the current market rate, you could get a better deal by refinancing your auto loan.

Before committing to any lender, check their reputation and customer reviews online. Also, look for lenders who offer flexible terms and no prepayment penalties so you can pay off your loan early without incurring extra charges.

Research any additional fees associated with refinancing – some lenders may require origination or application fees.

When looking for the best deal, it's important to compare multiple lenders and see what they can offer you. You can also use an online auto loan calculator or another financial tool to determine the optimal monthly repayment plan and find a lender that meets your needs. Finally, take advantage of any discounts or promotions lenders offer to get the lowest rate possible.

By researching refinancing companies and comparing quotes, you’ll be better equipped to decide which lender is right for you. With the right research and comparison shopping, you could save money in the long run by refinancing your car loan today.

Determine if Refinancing is Right for You

If you’re considering refinancing your car loan, determining if it’s right for you is the first step. When making this decision, here are a few questions to ask yourself: How long have I had my current loan? How much do I owe on the car? What is the current interest rate of my auto loan? How low can I get the interest rate with refinancing?

Once you’ve answered these questions, reviewing all potential benefits and drawbacks of refinancing is critical. You should identify the amount you could save each month, the total cost of switching lenders, and any fees associated with refinancing.

Another important factor to consider when deciding if the time left on your current loan. If you have most of your loan term remaining, it may not be worth refinancing as you’ll need to pay closing costs and potentially extend the length of your car loan.

Before making any commitments, understanding the pros and cons of refinancing your car loan is essential. Pros and cons of refinancing are:

Pros

- Lower monthly payments

- Possibility of reducing your interest rate

- Consolidate multiple loans into one loan with a single payment

Cons

- Potential to extend the length of the loan

- Risk of paying more in finance charges over time due to increased loan term

- Closing costs associated with refinancing

When you’re looking to refinance your car, taking the right steps is key. By weighing all factors and understanding potential risks and rewards, you can be sure that you make an informed decision that’s best for your financial future.

Prepare the Necessary Paperwork and Apply for Refinancing

Preparing the necessary paperwork is one of the most important steps in refinancing your car loan. This includes gathering your existing car loan documents, such as proof of purchase, current loan balance statement and any other documentation relevant to the refinancing process.

Reviewing your credit report to give lenders an accurate picture of credit score is also wise. Once you have gathered all of the needed paperwork, you will be ready to begin applying for auto loan refinancing.

FAQs

What should I do after I refinance my car?

When you refinance your auto loan, it’s important to remember that the lender is now responsible for paying off the original loan. You will still need to make payments on time per your new loan terms or risk defaulting on the loan and damaging your credit score.

What is a charge-off?

A charge-off occurs when a lender declares the balance on an account to be uncollectible and writes off the debt as a loss. Once your loan is charged off, it will hurt your credit score. It’s important to make all your payments in full and on time to avoid this outcome.

What should I do if I have trouble making my car payments?

If you are having trouble making car payments, contacting your lender as soon as possible is important. They can assist you by restructuring your loan or providing other options. If refinancing is not an option, a payment plan may be available.

Conclusion

It’s important to note that not everyone is eligible for refinancing, so be sure you’r credit score is good enough before considering it. Before signing any paperwork, you should look at different financing options and compare terms from different lenders. Refinancing your car is an investment into your future financial success, so take the time to thoroughly understand how it works and if it’s right for you.